Cyprus has developed a favorable regulation on the taxation of intellectual property (IP), which is now fully in line with international developments in relation to the proper treatment of license revenues and the OECD guideline.

Up to 80% of the license income is tax-free. With a corporation tax of 12.5%, this can lead to an effective tax burden of only 2.5%. In the past, this was simply true of all types of IP. Tax benefits have been severely curtailed to ensure compatibility with the OECD and the EU. Under current law, trademarks and copyrights are no longer covered by the solution. In addition, it must be proven that the intellectual property was actually created by the Cypriot company.

How does it work?

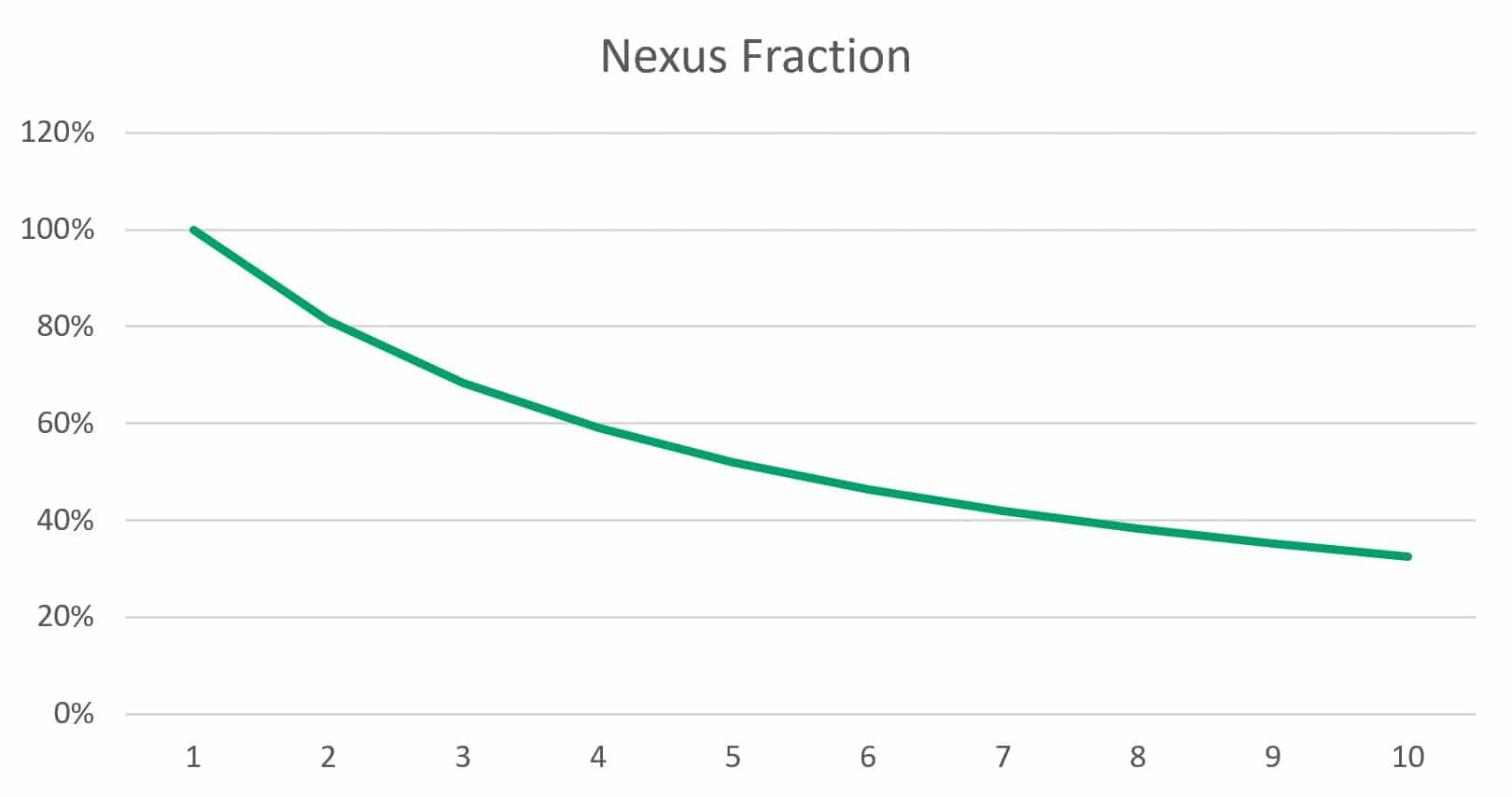

Cyprus relies on the Nexus approach to calculate the proportion of license revenue that qualifies under its regulation. The formula is used to find a percentage. Let us explain the rather complex calculation in a simplified manner below.

This calculation must be applied separately for each individual intellectual property. Hence, it is necessary that your bookkeeping consists of separate records of income and expenses for each individual IP. If this is not possible from an organizational point of view, a grouping may also be possible, at least to a certain extent. It is best to contact your tax advisor.

The benefits do not apply to trademarks or copyrights such as photos or logos!

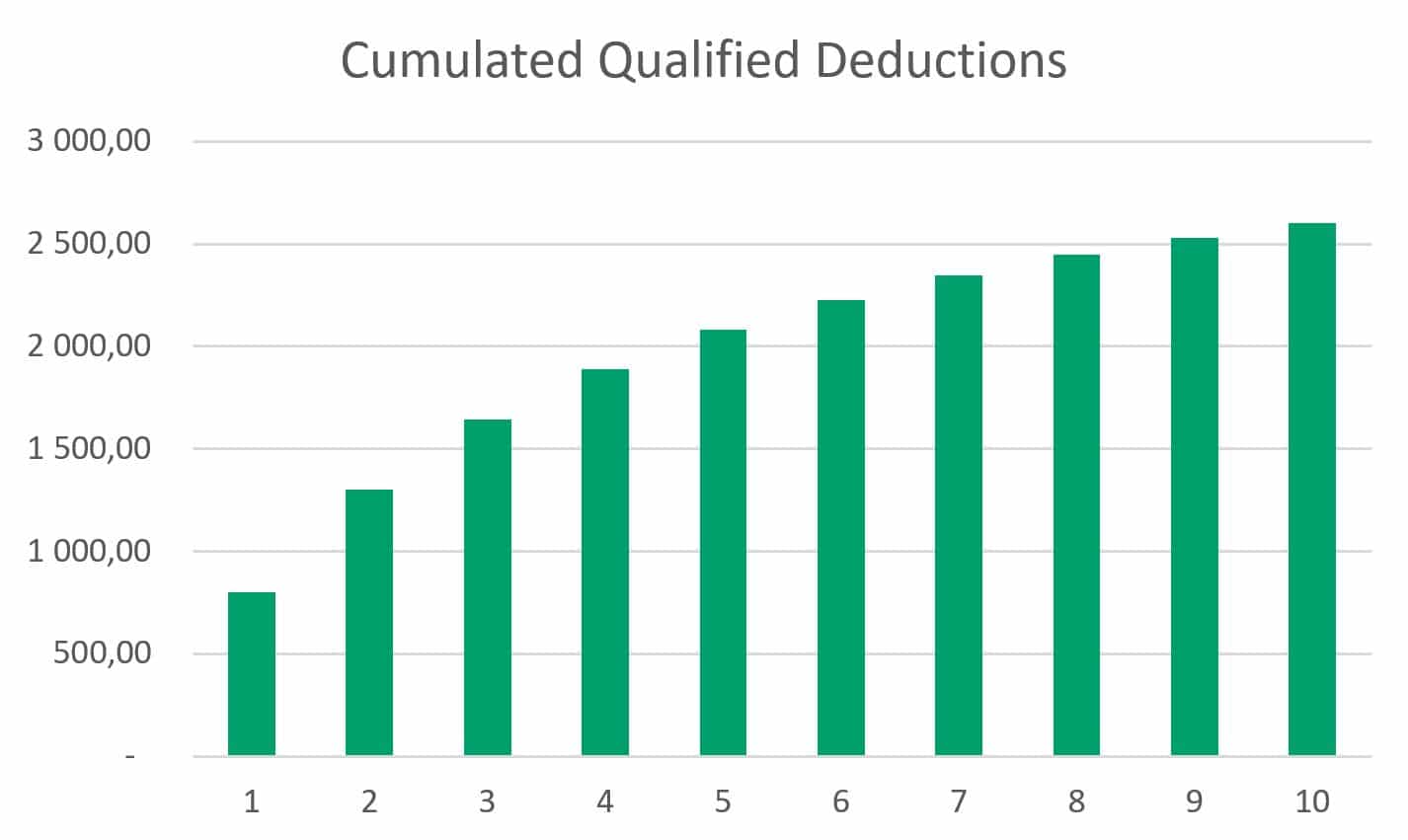

The calculation is cumulative. This means that over the life of the intellectual property, for example a patent, all income and costs accrued during this period are included in the calculation. This consequently means that the factor decreases when license revenues are generated while at the same time no further costs are incurred. The figure “Accumulated qualified deductions” shows the accumulated value of the deductions for an investment of 3000 € in the event that no use occurs.

For each tax year, the taxpayer can apply for full, partial or no allowance. Should this lead to a loss, only 20% of the resulting loss may be carried forward or passed on to other companies within the group of companies. The figure “Cumulative Qualified Deductions” shows the accumulated value of the deductions in the event that no use occurs.

How to calculate the Nexus Percentage?

Qualified Intellectual Property (QA)

refers to an asset acquired, developed, or used to promote its business by a company (other than intellectual property related to marketing) and the result of research and development, including intangible assets, for which there is only beneficial ownership.

The provisions of the new IP box regime only apply to:

- Patents within the meaning of the Patent Act,

- Computer software and

- other intangible assets that are protected by law and fall into one of the following categories:

- Utility models, rights for the protection of plants and genetic material, names of orphan drugs and patent extensions

- not obvious, useful and novel, but only if the gross annual income of the company it uses to promote a business does not exceed a threshold of € 7,500,000 from all intangible assets (or € 50,000,000 for a group of companies) . . Such assets must be certified by a competent authority in Cyprus or abroad.

Company names (including trademarks), trademarks, image rights, and other intellectual property rights used to market products and services are not considered qualifying intangible assets.

Overall Income (OI)

Overall income refers to gross income minus any direct expenses on that asset. This includes license fees for the use of the intangible asset and trading proceeds from sales. Direct costs are any direct costs incurred in generating income from intellectual property, including amortization of the cost of the intellectual property and notional interests, as well as embedded costs, e.g. license costs for products created with the IP.

Capital gains from the sale of an intellectual property are not included in total income and are usually completely tax-free.

Overall Expenses (OE)

Overall Expenses (OE)

The overall expenses consist of the eligible costs, the total acquisition costs of the property and the research and development costs of the activities of affiliated companies during a tax year.

Qualifying expenses (QE)

Qualifying expenses in this context are the total research and development costs incurred in a tax year entirely and exclusively for the invention, development or improvement of the intellectual property, as well as other directly related costs. This includes salaries and wages, direct costs, general expenses for R&D activities, and R&D expenses for unaffiliated contractors.

They do not include the acquisition cost for intellectual property, interest paid or payable, amounts owed to affiliated R&D contractors, or costs not directly related to any particular intellectual property.

Qualifying Profits (QP)

Qualifying profits refer to the portion of the income to which the tax break can be applied. It is determined according to the formula

OI * Nexus percentage

The Nexus percentage results from the formula

0.01 * (QE + UE) / OE

Uplift expenditure (UE)

The lift expenses refer to the lower value of

- 30% of Qualified Expenditure (QE) or

- the total acquisition costs of the qualified intellectual property plus all R&D costs incurred by the associated contractual partners